Nintendo will release the Switch 2 next month. The question for game developers is whether you should support it. And if so, when, and how? Here are seven signals to watch, whether you are porting an existing game or developing a new title for the Switch 2.

- Switch 2 Hardware Pricing

- Switch 2 Game Pricing

- Third-Party and Free-To-Play Title Sales

- GameChat in Third-Party Titles

- YouTuber Teams on Switch 2

- Accessories as Infrastructure

- Global Reach

Switch 2 Hardware Pricing

Switch 2 is priced at US$449.99. Switch 1 was US$299.99. That’s an increase of $150. It may not matter to early adopters, but will impact the majority of gamers. Will this lead to a slower launch, or a price cut?

Nintendo has cut console prices before. In 2011, they reduced the 3DS price globally from US$249.99 to US$169.99 less than six months after launch. If early sales are below even their most conservative expectations, price cuts could happen again.

A more realistic scenario is a price cut outside Japan. With today’s exchange rate, $449.99 equals about 64,000 yen, but the Japanese price is just 49,980 yen. That’s a gap of roughly 100 dollars. When the yen gets stronger and Nintendo decides to push sales overseas, they may adjust overseas pricing.

That said, Nintendo may not be too concerned about a slow start. There are still five months before the holiday season, and their production capacity is limited. Pre-orders look strong. Early adopters are likely to buy regardless of the price. But towards the holiday season, if Nintendo sees weakness in their launch, we might see a price cut.

Switch 2 Game Pricing

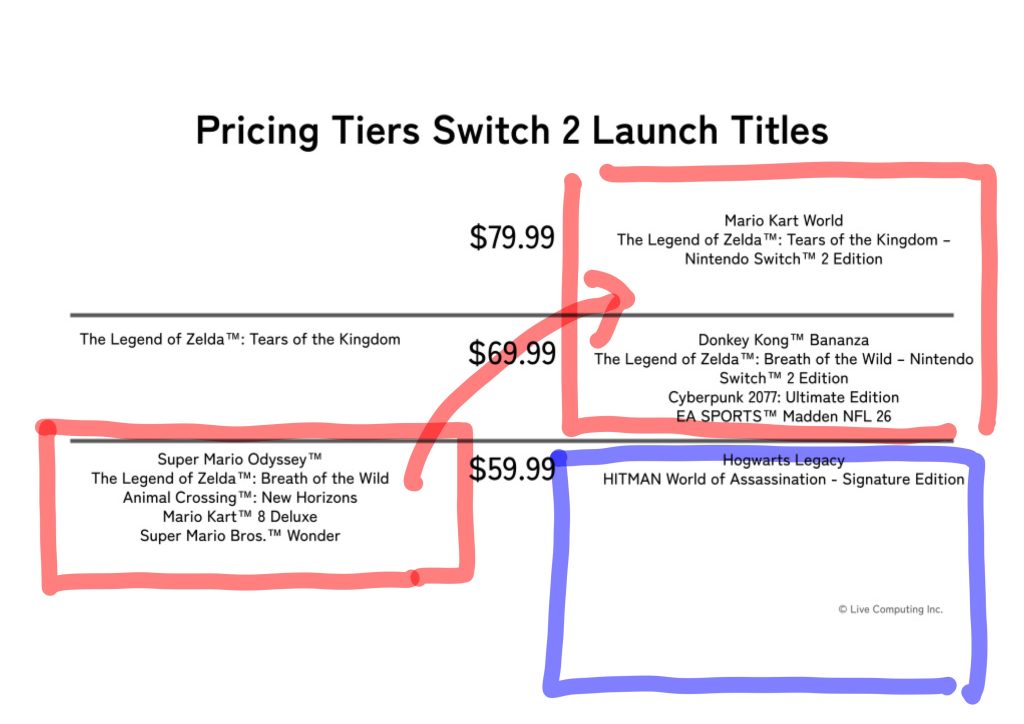

One of the Switch 2’s launch titles, Mario Kart™ World, is priced at US$79.99. Its predecessor, Mario Kart™ 8 Deluxe, is US$59.99. That’s a $20 increase, even above recent AAA titles like Call of Duty Black Ops 6 or EA Sports FC 25, which launched at $69.99 last year.

Nintendo is trying to establish a new price tier for AAA titles, not only for themselves but for third parties too. If Mario Kart World sells well, others may follow by raising prices on their Switch 2 titles. They might even raise their prices on PS5 and Xbox games. This could push AAA prices higher across the industry, possibly increasing revenue for Sony, Microsoft, and AAA game publishers.

The second tier is at $69.99 where Donkey Kong™ Bananza is positioned. This matches the price of recent AAA titles across consoles, and many new first-party releases and remakes will likely fall into this zone. If titles at $69.99 sell well relative to Mario Kart World, there may be room for third-party titles to target this zone. You could even position your title at $59.99 or $49.99, which may be underserved by Nintendo’s own lineup.

In other words, Nintendo is developing a multi-tier pricing strategy while also raising the standard. Will the $80 price tag become the new norm for AAA titles? Will there still be space for $59.99 third-party titles? These are the questions all developers around the world will be asking.

Third-Party and Free-To-Play Title Sales

Historically Nintendo had a love-hate relationship with third-party publishers. The Wii sold well, but success was limited to Nintendo’s own titles. The Wii U underperformed so much that it hurt many publishers who invested in the platform.

With Switch 2, Nintendo is trying to align itself with third-party publishers by prioritizing continuity over uniqueness with Switch 2. But publishers are anxious to see how third-party titles perform.

Cyberpunk 2077 is a good test case. Unlike Hogwarts Legacy it was never released on Switch 1. It is a graphically demanding title, and if players are satisfied playing on Switch 2, that will show what single-player role-playing games could perform well on Switch 2.

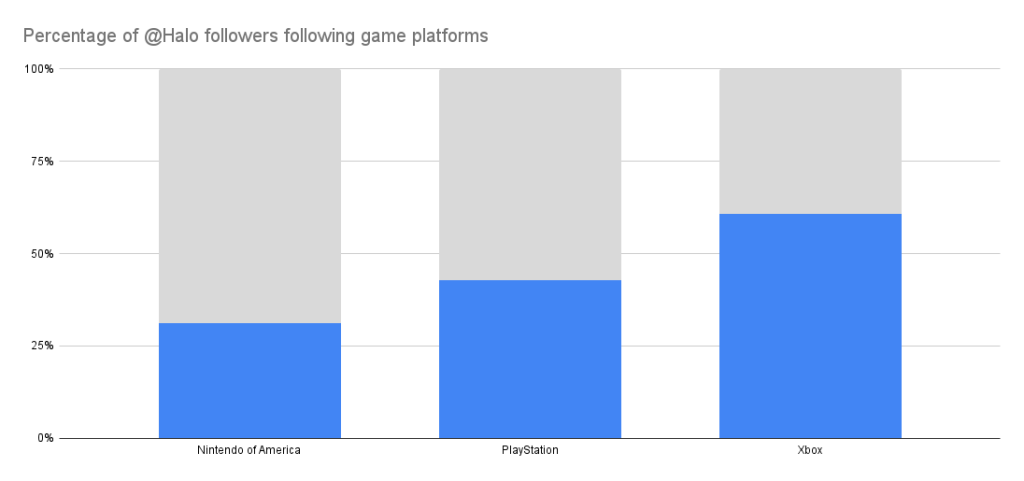

Nintendo might push back against escalating graphics expectations with the Switch 2. If players are satisfied with Cyberpunk 2077 or Street Fighter 6 or Fortnite on Switch 2, they might select Switch 2 over PS5 or Xbox. Unlike most of us developers, consumers cannot afford to buy two different consoles. Third-party title sales could signal a shift in the competitive landscape between consoles.

GameChat in Third-Party Titles

In the April 2nd Nintendo Direct, Nintendo introduced the C button right after showcasing Mario Kart World. What they emphasized was not a new type of controller like the Wii Remote, not upgraded specs, not other first or third-party titles. Nintendo chose to highlight the communication feature, not the hardware.

While I am not developing any Switch 2 titles at the moment, I can imagine Nintendo strongly urging developers to integrate GameChat features into their titles. Not only to first and second parties but to third parties. They are encouraging players to invite friends, which could in turn drive Switch 2 purchases.

If third-party titles integrate GameChat deeply and sell well, that may be an indicator of Switch 2’s positive momentum. It may also open the door for more third-party developers to follow.

YouTuber Teams on Switch 2

Group chat built into the console will lower the barrier for streaming games directly from Switch 2. But Switch 2 has the potential to create a new generation of YouTubers and Twitch streamers who act as teams, not just individuals playing with friends

Think of it as watching team sports like football or basketball, compared to individual sports like golf or tennis. Viewers can enjoy watching how players work together to win, and how different personalities within the group create entertaining interactions.

Sure, this can happen on PS5, Xbox, or PC. But it hasn’t yet. Many videos feature one YouTuber playing with friends, but not as a team of players, each with their own appeal on YouTube.

The signal is simple: will Switch 2 be the platform where group streamers finally take off?

Accessories as Infrastructure

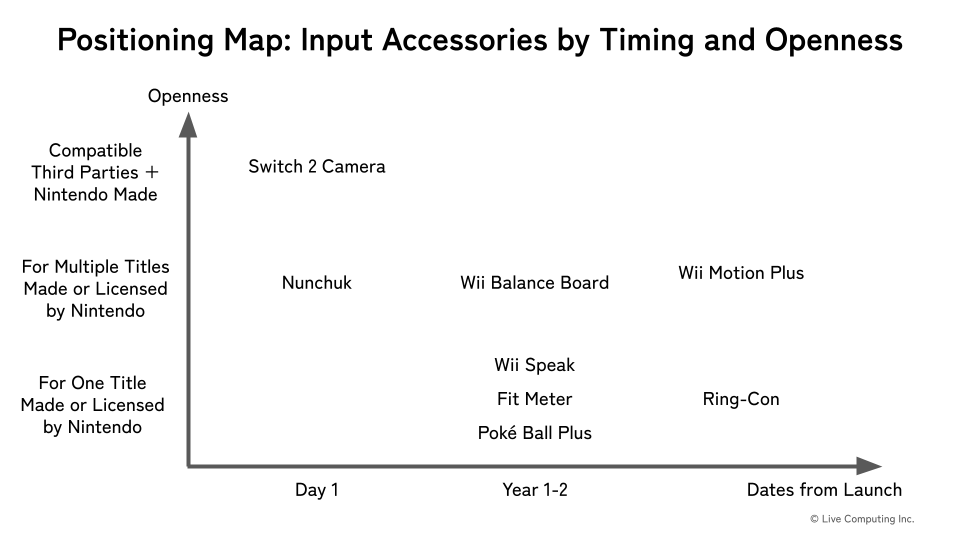

Nintendo is providing a dedicated camera on day 1. It even supports compatible USB-C® cameras to the system. They are not trying to generate accessory revenue, but to create infrastructure.

If titles start to use the camera creatively and players like the feature, the camera will become infrastructure. It will create new types of gameplay as well as daily non-game interaction with the system.

The camera is like a hidden weapon. It may not spread widely, even if the Switch 2 itself sells well. But if developers and players accept it, the camera won’t be just an accessory. It will become infrastructure. That’s a signal worth watching.

Please visit our other post for more.

Global Reach

EFIGS—English, French, Italian, German, and Spanish—has long been the standard in game localization. Today, Switch 1 has 12 languages. Switch 2 has 16 languages, although the added ones are variations like US English and UK English. The direction is clearly towards adding languages to cover more areas.

Nintendo might actively target underserved areas aggressively with the Switch 2. In their earnings announcement on Nov. 8, 2023, they said The Super Mario Bros. Movie covered more areas than their consoles did, adding that it would “have a positive effect on our business going forward” (slide 16).

An additional factor supporting global reach is the rise of digital downloads.

This enables publishers to price software lower in developing countries and bypass traditional retail barriers. If Nintendo Switch 2 succeeds in areas previously underserved by game consoles, it can open up a new volume market for third-party developers. It might not happen. And even if it does, it may not be publicly discussed, since neither Nintendo, Sony, nor Microsoft provide a breakdown of their sales by country. Yet it is a signal to watch, if you are planning to launch globally.

What’s Next

These seven areas are all basics for industry professionals but can serve as a useful checklist for assessing Switch 2’s health as a platform. For those outside the industry, I hope these viewpoints offer a helpful lens for examining the game industry for the late 2020s.

Feel free to ask any questions in the meantime, and thank you for reading. I’ll be writing more on a few of these topics in the coming weeks.