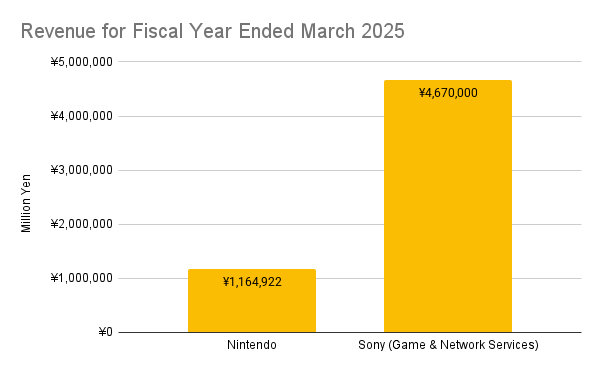

Did you know that Sony’s Game & Network Services segment earns more than three times the revenue of Nintendo’s, despite similar console shipments?

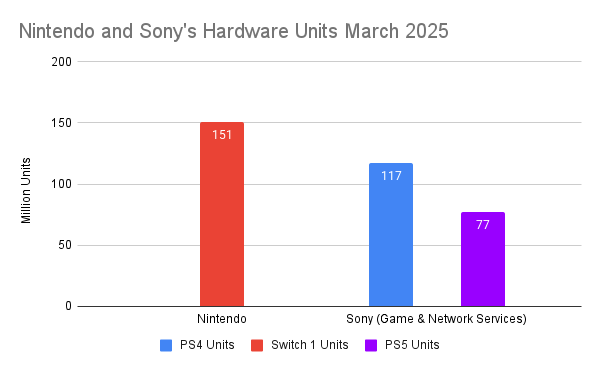

As you can see in the chart below, shipments for the original Switch have surpassed those of the PS4, but PS4 and PS5 combined exceed the total lifetime shipments of the Switch. Sony drives higher revenue per user, fueled by upfront sales of premium third-party titles and stronger monetization of free-to-play games.

Sony’s Financial Results for FY2024

Nintendo’s Financial Results for FY2024

Can Nintendo change the landscape with the Switch 2?

Increasing Software Prices

Nintendo increased the price for its flagship title, Mario Kart™ World, to $79.99. This alone could raise Nintendo’s revenue by hundreds of millions of dollars, if the Switch 2 gains broad adoption and the new title sells as well as its predecessor.

Not all Nintendo titles are priced at US$79.99 though. Fresh new titles like Donkey Kong™ Bananza are sold at $69.99. Ported titles like The Legend of Zelda™: Breath of the Wild – Nintendo Switch™ 2 Edition are also priced at $69.99. Still, these prices represent an increase from the original Switch’s $59.99 standard.

How customers will react to this price increase remains unclear. Nintendo is undoubtedly reviewing early sales data. The issue is whether to extend the $79.99 pricing to additional titles. Their strategy might become clear at their earnings release on Aug. 1, 2025. If not, we may need to wait for price announcements for this holiday season around September.

Ironically, Nintendo’s price hike may help Sony. If Nintendo appears confident in selling $79.99 titles, others will follow. Third-party titles like Grand Theft Auto VI, if sold at $79.99, will benefit both Sony and Nintendo. Even if the price increase boosts Nintendo’s revenue, the gap between Sony and Nintendo might not narrow.

Whether the $79.99 strategy marks a shift in Nintendo’s long-term direction, or simply a test, will become clearer in the months ahead. But one thing is certain. Pricing alone won’t define the Switch 2’s success.

Increasing AAA Title Sales

Attracting premium third-party titles has long been a challenge for Nintendo. But its unique hardware inputs and lower specs have made it difficult to attract and sell blockbuster third-party titles like Grand Theft Auto V. Will the Switch 2 change the situation?

Controls are not the problem for the Switch 2. Unlike the Wii which had unique controllers, the Switch 2 continues the control format of its predecessor, letting third-party titles adapt easily.

The problem is the technical specs. Can the Switch 2 attract more AAA titles than the original Switch?

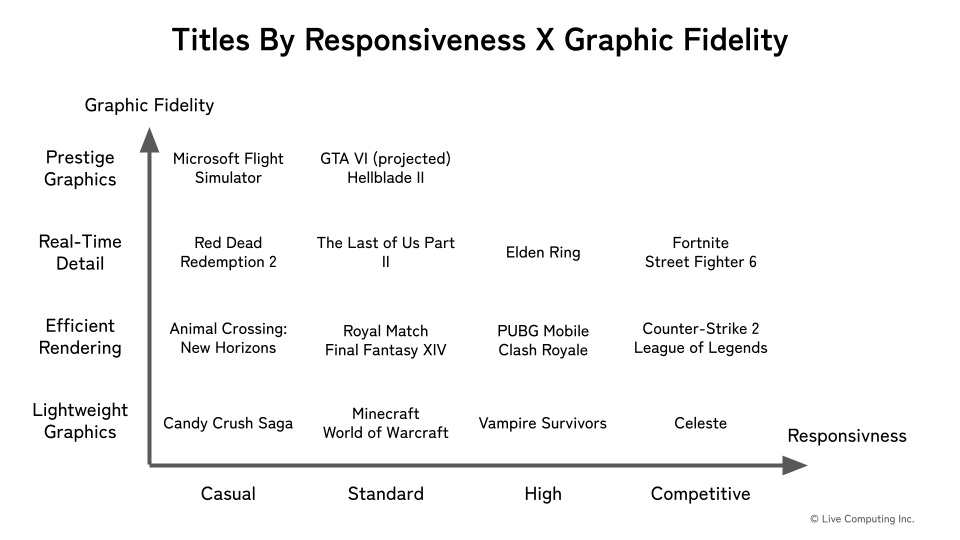

When developers and players discuss technical specifications, they typically mean two things. Responsiveness refers to how quickly a game reacts to player input, while graphic fidelity describes how realistic or visually rich it looks.

The chart below maps major titles by responsiveness and graphic fidelity. For more context, please visit the related article linked below.

Fidelity × Responsiveness: A Framework for Positioning Games and Platforms

It is still too early to jump to conclusions, since actual performance depends heavily on software. But early signs suggest that while its graphic fidelity may not match the PS5, the Switch 2’s responsiveness is approaching PS5 levels. Graphic fidelity may be reaching the point where further improvements matter to fewer players. If the Switch 2 can support modern AAA titles well enough, will players still choose PlayStation?

There are two good leading indicators. One is Cyberpunk 2077: Ultimate Edition, which brings a widely popular title to the Switch platform for the first time. Players who have already experienced the game on other platforms might find the Switch version disappointing. But are new players buying the title, and are they enjoying the experience? If this title sells well, it may show that people are fine with the fidelity provided by the Switch 2, even though it doesn’t match the visual quality of the PS5 or PC versions.

Another indicator is The Duskbloods, an exclusive title for the Switch 2 from the developer of Elden Ring, scheduled for release in 2026. Elden Ring is a title that drives hardware sales. If The Duskbloods is received as positively as Elden Ring, it will certainly help expand the Switch 2’s user base. More importantly, it may reduce PS6 demand. If players are satisfied with the experience and AAA publishers begin bringing their titles to the Switch 2, many players may no longer feel the need for a PlayStation 6.

Increasing Free-to-Play titles’ revenue

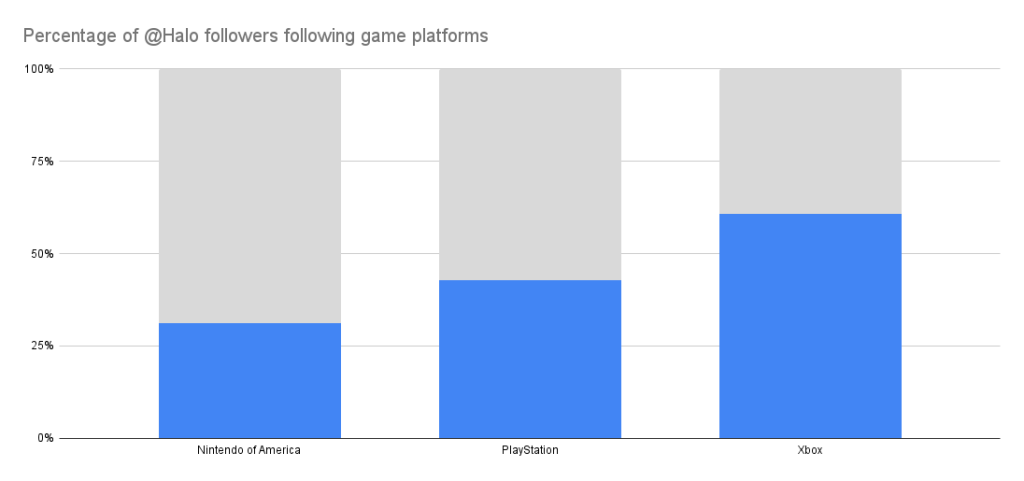

Between March 2018 and July 2020, PlayStation 4 accounted for 46.8% of Fortnite’s total revenue, followed by Xbox One at 27.5%. The original Switch was not a major platform for monetizing free-to-play audiences. So how might that change with the Switch 2?

The original Switch didn’t offer a wide variety of free-to-play games, partly because of limited technical specifications. If the Switch 2 narrows the performance gap, it may finally attract a broader portfolio of monetizable live-service titles.

The main issue though, is Nintendo’s brand image as a casual and family-oriented game console. Will customers look at the Switch 2 differently, as a hardware for both kids and adults? The price increase from $299.99 to $449.99 may contribute to that shift.

Nintendo doesn’t treat free-to-play titles as a meaningful source of revenue, or as a way to retain users across hardware generations. This is reflected in how they position these titles behind full-price games on the eShop. In contrast, the PlayStation Store often highlights free-to-play games up front, alongside major premium releases.

If Nintendo sees a momentum in premium third-party titles and increase in adult gamers, they may change their course. But first they need to grow AAA titles and players. Growth in free-to-play revenue will come later, if it comes at all.

Narrowing the revenue gap between PlayStation

Revenue per user will certainly increase with the Switch 2 compared to the original. Casual players are likely to accept the higher prices for Nintendo’s first-party titles, since these titles are only available on Nintendo’s hardware. But many of these players tend to stick with a single title for years.

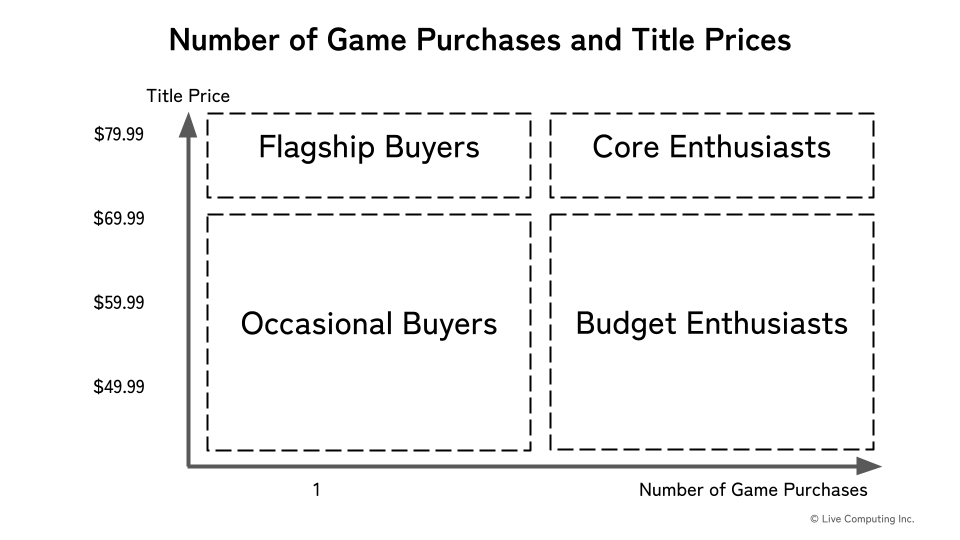

To grow total revenue, Nintendo needs to attract frequent buyers. These are the players who purchase multiple titles per year, not just Nintendo’s first-party games. Reaching them requires a stronger third-party library, something Nintendo appears focused on with the Switch 2.

The chart below segments games by the number of titles they buy and the price of the game. Please visit our other blog for details.

Nintendo Raised the Price Ceiling with Switch 2. What It Means for Game Publishers

The $449 price tag for the Switch 2 suggests that Nintendo may no longer be playing just for families. But whether core players and publishers will join, remains to be seen.