Streaming services compete with originals. In 2013, Netflix set the tone by receiving major Emmy nominations with its first original, The House of Cards. In 2019 Disney followed by launching with more than 10 exclusives, reaching 10 million sign-ups in a few days.

Originals are attractive, but expensive. Netflix invested $100 million in The House of Cards. Disney’s Direct-to-Consumer segment is losing money. Service providers and investors need to know whether focusing on originals are leading to profit.

Unlike cable TVs, switching between streaming services is easy. When customers are interested, competing services are a few clicks away. Therefore measuring customers’ interests is crucial. It will reveal how stable or risky streaming services businesses are.

We studied two Disney+ exclusives. It turns out that fans of both titles’ are more interested in Netflix than Prime Video. Disney seems to be fighting over the same market with Netflix. They may need to create different types of originals, or differentiate in some other way.

Measuring customer interest with Twitter API

How can we measure customers’ interest? Today, many customers turn to social media for new information. They follow accounts that seem continuously interesting.

Twitter provides limited but valuable information through Twitter Developer Platform. Using the data available, we’ve built a system called “Twitter Correlation Analysis” to answer our questions. Twitter correlation analysis measures how an account’s followers are following other accounts. It reveals how fans are interested in other brands, products, platforms, media and influencers.

From here on, we will mention a rather unfamiliar term, following rate. The rate shows the percentage of followers following another account.

Following rate = number of followers following other account / number of followers of the basis account

Please visit our other post for more information about Twitter correlation analysis.

How exclusives’ fans follow Disney+

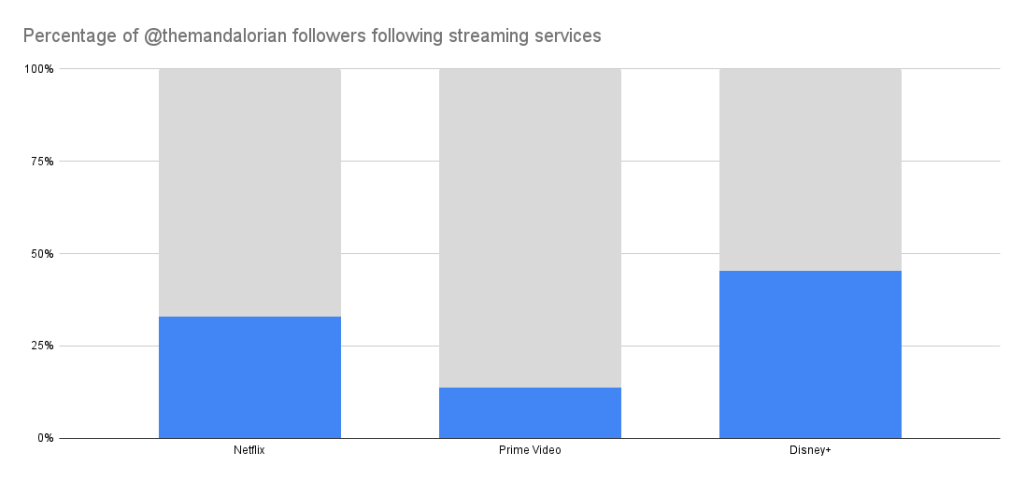

The Mandalorian is a new Star Wars series for Disney+. As of December 2022, their official Twitter account(@themandalorian) has nearly 800,000 followers. Among those followers, 32.8% also follow Netflix.

In our terms, The Mandalorian’s following rate to Netflix is 32.8%. This is high, compared to 13.8% for Prime Video. Disney+ has opportunities to acquire customers from Netflix, but also risks losing them to Netflix or frequently being switched between the two.

Source : Twitter / Live Computing

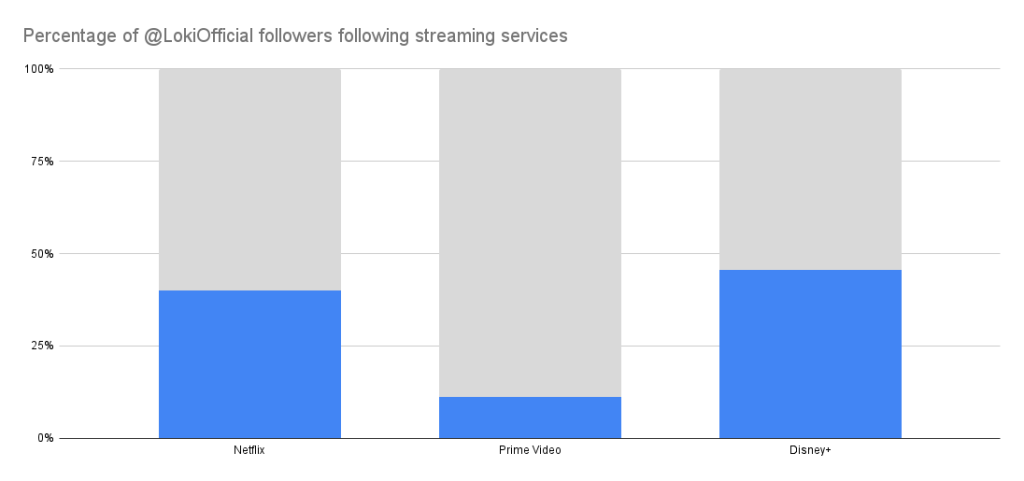

Let’s look at another Disney+ exclusive, Loki. Loki‘s Twitter account (@LokiOfficial) has a 40.0% following rate towards Netflix, even higher than The Mandalorian. This is close to Loki’s following rate to Disney+ itself, which is 45.6%, as we’ve studied in another post.

The following rate against Prime Video is 11.2%, lower than The Mandalorian. Both titles are similar, high following rates for Disney+ and Netflix, low rates for Prime Video.

How exclusives’ fans follow Netflix

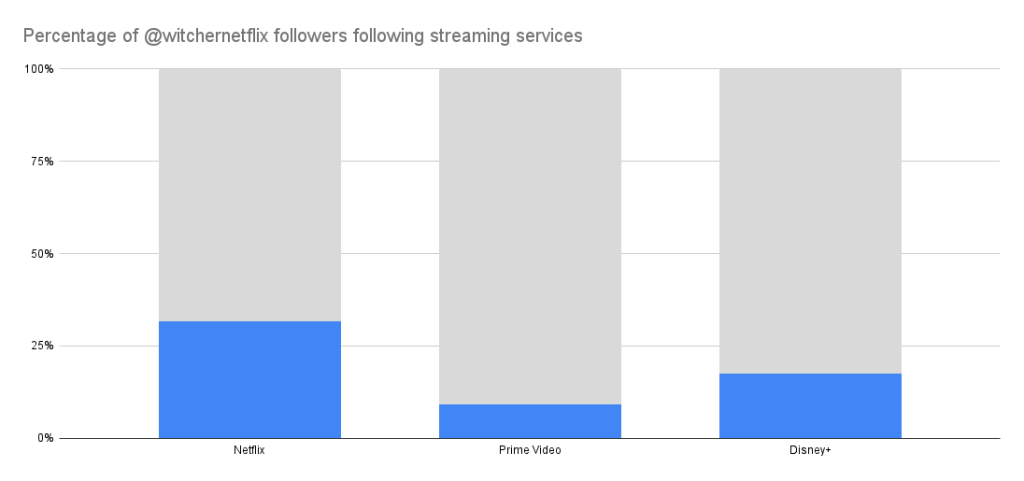

For comparison, let’s look at a Netflix’s exclusive, The Witcher. The Witcher’s Twitter account(@witchernetflix) has over 530,000 followers.

Towards competing services, The Witcher shows lower following rates than Disney+ exclusives. The following rates to Disney+ and Prime Video are 17.4% and 9.3%, respectively. The Witcher’s fans are not as interested in Disney+ as The Mandalrian and Loki fans are interested in Netflix.

Disney+ is fighting on Netflix’s battlefield

Disney+ is fighting on Netflix’s battlefield. Not 100%, but 30-40% of its customers overlap with Netflix. From Netflix’s side, Disney+ is invading roughly 20% of the market they created.

They are aware of each other, of course. Both Netflix and Disney+ launched an ad supported tier in 2022. Disney+ is following Netflix’s strategy creating local content. But Disney has a higher risk of losing customers to Netflix, than vice versa.

Disney has two options. One is to compete with Netflix and others in the streaming war. They have a good chance of surviving, although profitability remains in question. The other is to differentiate without original programs.

Integrating different media under each Disney IP

How can Disney differentiate without original programs?

For decades consumers enjoyed digital contents separately, DVD players for movies, consoles for games. Now they can enjoy all of them in a single device, whether a smartphone, tablet, or PC. Digital contents are all competing for customers’ leisure time. They even compete with services like TikTok, since social media are also available on the same device.

Disney’s possible first step is to combine their digital contents. They can create a digital atmosphere of a brand(IP) such as Beauty and the Beast, with animations and games. They can let fans create buildings and items, although character creating and editing should be avoided. Disney can charge customers with monthly fees, item purchases or both. They can create different services for each brand, or combine brands into a single service.

Their second step is to combine digital contents with physical content. Pokemon Go has expanded Pokemon’s customer base by acquiring users who never played or watched Pokemon(Since Pokemon debuted in 1996, they missed reaching out to people who were above 15 by then). Disney can bring customers to and from theme parks and stores, extending the experience digital services can offer on its own.

Since I am a game producer, this proposal comes from my cloud gaming concepts. Some might call this a creator economy. Others say it is a metaverse. Whatever your take, the idea is to combine different media, get customers involved in creation and communication, and build a unique business model competitors cannot copy.

Mickey Mouse will enter the public domain in 2024. There is no way back to the cable TV business. Disney’s streaming business alone is not profitable. The high following rates towards Netflix implies that they need change.

Remaining questions

This post featured two Disney+ exclusives, but other exclusives might show different following rates. How are Pixar and National Geographic fans interested in Netflix?

Streaming services other than Disney+ have exclusives too. What are the following rates of Netflix, Prime Video or HBO’s exclusives?

We will cover these topics in other posts. Please let us know your thoughts and questions via our Twitter account.

Thank you for reading!